Vice President,

Simeio

Upcoming Summits

Upcoming Summits

Half-day Rapid Summit for Executives and Senior Managers

Friday,

October 1, 2021

10:00AM - 1:30PM EDT

Earn 3 CPE/CEU Credits

with Full Attendance!

CISOs, VP and Director of IT or Security, Senior DevSecOps, Cloud and Security Architects and IT security professionals from Financial Services & FinTech industry

Contact Samantha@CyberSummitUSA.com

or call 212.655.4505 ext. 247

If you run into any issues registering, please try using a different browser.

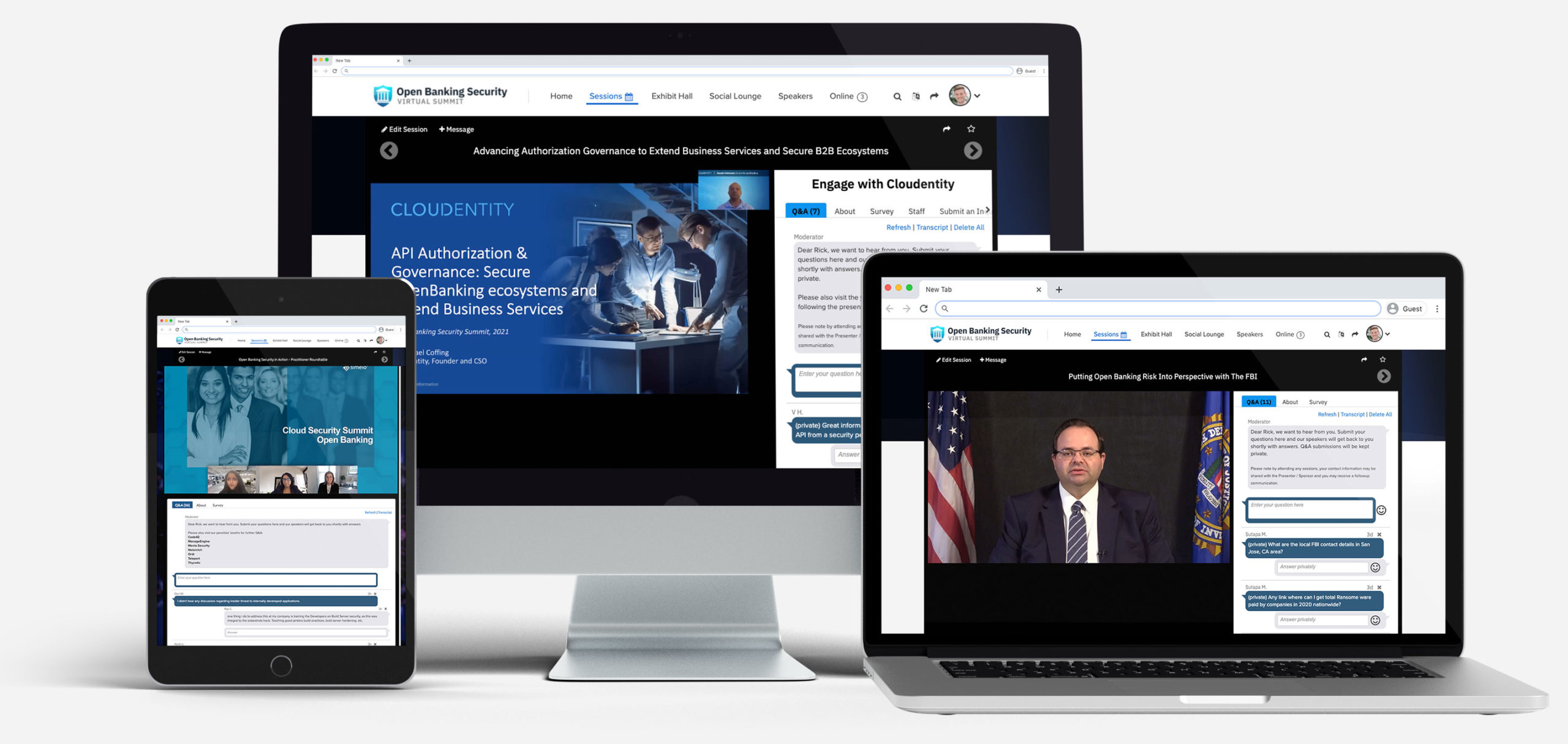

View all summit video presentations & panel discussions now by registering or signing into the Engagez platform!

The First Annual North American Open Banking Security Summit delivers a rapid-session, half-day virtual conference designed to connect executives and senior managers responsible for advancing capabilities, controls and privacy that support their organization’s Open Banking initiatives. Connect with peers, experts and innovative solution providers as they share best practices, technologies and experiences towards progressing Open Banking programs. Admission is FREE to qualified registrants – giving you access to all keynote discussions, interactive panels, and leading solution vendors. With half-day attendance, you will earn 3 CPE/CEU Credits!

Arandhna Chetal

Sr. Director Executive – Cloud Security

TIAA

Terra Carnrike-Granata

SVP, Director of Information-Security

NBT Bank

Data Privacy and Compliance

Explore key Open Banking requisites to ensure consumer trust and privacy compliance

API and Transaction Controls

Examine best practices to mitigate internal and external access, attack, and data leakage risks

Fortify Identity Governance

Discover crucial entity and consumer identity validation and granular authorization controls

Rapid Format

The conference has been designed to optimize the time of busy executives and leaders by providing short sessions that present most relevant topics that can be put into immediate use.

Learn

Hear from experts and practitioners as they convey crucial issues, controls, considerations, and techniques.

Convenience

Many senior executives simple don’t have the time to travel to large cyber security events – or take on additional health exposures. Gain knowledge-transfer and engagement from the comfort and safety of your own home/office.

Interact

Engage and network with hundreds of your fellow executives, leaders, developers, innovators and entrepreneurs across the financial services, Fintech and cyber security industry.

CEU/CPE Credits

By attending the entire half-day virtual summit, you will then receive an electronic certificate granting you 3 Continuing Education Unites or Continuing Professional Education Credits.

Value

Save your organization resources, time, and risks – be better prepared to address Open Banking challenges and opportunities.

Professional Atmosphere

This Open Banking security summit is “by invitation only” and attendees are pre-screened and approved in advance. Attendance is limited to approximately 300 executives and senior leaders to maintain an intimate learning and sharing environment.

Live Sponsored Break Hall

Meet technology leaders and innovators that are empowering their financial services customers to progress and secure their Open Banking programs.

QUESTIONS

For any questions, please contact Samantha@CyberSummitUSA.com or call 212.655.4505 ext. 225

SPONSOR

To sponsor, speak or exhibit at an upcoming summit, contact BRand@CyberSecuritySummit.com or call 212.655.4505 ext. 223

Open Banking promises to revolutionize the experience of banking as we know it. By enabling a vast array of new financial services, Open Banking presents customers with even more avenues to support their financial wellness. It also offers new business and service innovation opportunities for banks and FinTech companies alike. However, Open Banking introduces new cyber threat, and privacy concerns, as well as compliance requirements.

This online Open Banking Security forum will focus on providing attendees the most relevant topics that can be put into immediate use. Hear from experts and practitioners as they convey crucial trends, issues, controls, considerations, and techniques to better enable, manage, and fortify Open Banking programs within your organization. During the virtual summit, you can socialize with peers and meet leading security technology and service providers online in the summit exhibition hall.

10:00-10:05

Bradford Rand

President & CEO

The Official Cyber Security Summit

10:05-10:20

10:25-10:55

Nathanael Coffing

Co-Founder, CSO and Board Member

Cloudentity

Open Banking provides financial institutions the digital transformation opportunity to be at the center of the privacy and consent discussion with their customers and partners. The central tenet is how to expand business by securely sharing data based on consent for new B2B / B2B2C services such as insurance, investment, mortgage, pension management. This session will share current challenges, policy management requisites, and control options that enable customer engagement and trust while securing extended service portfolios. Attendee will learn:

11:00-11:20

To promote a healthy, competitive marketplace within the financial services industry, Open Banking empowers consumers and small businesses to access new products and services, greater inclusivity to their financial data and decisions, and control over granting access to their financial data with third parties of their choosing. Enabling consumers to securely share their financial data requires that financial institutions and fintech companies adhere to financial-grade identity standards, user data privacy and consent obligations, and standards-based application development/APIs, and data exchange authorization practices. Attendees will learn:

11:25-11:50

Jacquelyn Painter

Senior Solutions Product Marketing Manager for Financial Services

Okta

Secure identity management has evolved to support how customers engage with financial institutions, and how institutions leverage applications and data internally and through their partner ecosystem to drive new business. How do core identity-driven functions enable federated, policy-based access and data privacy? This session will align key IAM and security functions across organizations, customers, and external partners to the core principles of Open Banking. Attendees will learn:

11:55-12:30

Batool Aliakbar Arandhna Chetal Terra Carnrike-Granata

Vice President

Simeio

Senior Director Executive - Cloud Security

Teachers, Insurance, and Annuity Association (TIAA)

SVP, Director of Information-Security

NBT Bank

Open Banking is at various planning and implementation phases across the financial services industry – it is the future of consumer financial services and how institutions will remain both relevant and competitive. This requires institutions to further leverage internal and third-party applications and data in a way that aligns to their business risk profile. This practitioner roundtable offers real-world perspectives towards how organizations are augmenting people, process, and technology to support their Open Banking programs. Attendees will learn:

12:00-1:30

Obtain information, meet with representatives, and schedule follow-ups.

12:35-1:00

Eyal Sivan

Head of Open Banking

Axway

Open banking is revolutionizing how consumers manage their money. Institutions no longer unilaterally control their customer’s data, and to be agile, will require expanding access to internal and external applications and data pools. The need to bolster API and service management is more crucial than ever. This session explores API and service management best practices to support Open Banking security and compliance. Attendees will learn:

1:05-1:10

1:30

Discuss and share the latest in cyber protection with our renowned security experts during interactive Panels & Round Table discussions. View our Security Content Sharing portal for past Cyber Security Summit solutions to protect your business from cyber attacks.

The Cyber Security Summit connects cutting-edge solution providers with Sr. Executives to analyze & diagnose cybersecurity flaws through interactive panels & roundtable discussions. View the latest presentations given at the Cyber Security Summit through our Security Content Sharing portal.

Axway gives heritage IT infrastructure new life, helping more than 11,000 customers worldwide build on what they already have to digitally transform, add new business capabilities, and drive growth. With our Amplify API Management Platform — the only open, independent platform for managing and governing APIs across teams, the hybrid cloud, and third-party solutions — we help companies move forward faster, reach new markets, and create brilliant digital experiences. Our MFT and B2B integration solutions have been trusted for 20 years. Axway (Euronext: AXW.PA) employs over 1,800 people in 18 countries.

Cloudentity provides the most flexible and scalable solution for authorization governance automation to secure digital business across an enterprise’s existing hybrid, multi-cloud and microservices infrastructure. Delivered as an external declarative authorization service, the platform empowers development to manage user, app and API registration and discovery, easily create and provision fine-grained policy as code, assure privacy consent, and gain continuous transaction-level enforcement at hyperscale. As a result, our enterprise customers have increased development velocity and service agility while mitigating privacy consent, API security and compliance risks.

Okta is the leading independent identity provider. The Okta Identity Cloud enables organizations to securely connect the right people to the right technologies. We provide simple and secure access to people and organizations everywhere, giving them the confidence to reach their full potential.

Simeio provides the industry’s most complete Identity and Access Management solution delivered as a service and interoperable with leading IAM tools. We protect over 150 million identities globally for enterprises, institutions, and government entities of all sizes. Our platform and services provide the following set of enterprise-grade security and identity capabilities: Access Management and Federation, Access Request, Directory Services, Identity Governance and Administration, Identity Management and Administration, Privileged Access Management, Security & Risk Intelligence, Data Security & Loss Prevention, and Cloud Security. Simeio IDaaS—which consists of Simeio Identity Orchestrator™ (IO), Simeio Identity Intelligence Center™ (IIC), and managed identity services—brings together best-in-class processes, professionals, and technologies focused entirely on management and protection of identities and related access controls. Headquartered in Atlanta, Georgia, and with Security Operations Centers worldwide, Simeio provides services to Global 2000 companies across all industries, and government entities.

Find out how you can become a sponsor and grow your business by meeting and spending quality time with key decision makers and dramatically shorten your sales cycle. View Prospectus

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |